Sponsored Post brought to you by moneysherpa.ie

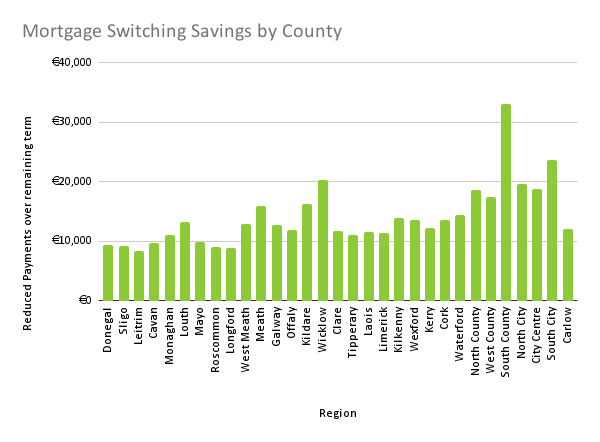

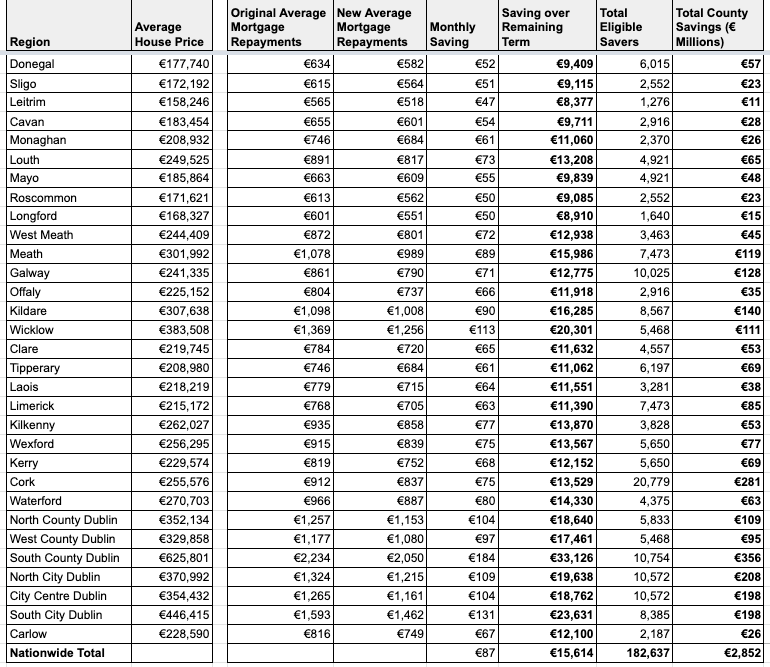

Over 180,000 households nationwide stand to save over €15,000 each by switching mortgage, also known as a remortgage. New analysis by moneysherpa.ie the Irish personal finance website has broken down how much could be saved county by county.

Locally more than 6,000 switchers across Donegal will save over €9,400 each by switching with €281 Million of savings across the county.

Savings have reached record levels due to a combination of rising house prices and falling mortgage rates for switchers. With higher house prices mortgage holders now have lower loan to values and can get lower rates.

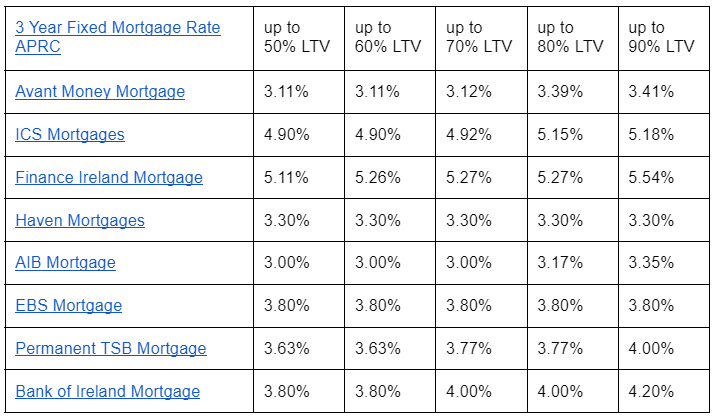

According to the latest data from the Central Bank of Ireland standard variable rate mortgage holders are on a mortgage rate of 3.48% and tracker customers on 3.25%, despite the best mortgage rate Ireland being 3.11% from Avant Money Mortgages.

With ECB rates now on the up, even current tracker mortgage customers are wondering if they should fix their tracker mortgage. If you are worried about rising repayments the answer may well be yes and you should check out the should I fix my tracker mortgage Ireland 2022 guide here.

Even if you are currently on a fixed mortgage rate, with increasing rates forecast it may make sense to fix to a longer fixed rate. You can read about breaking and refixing your fixed rate mortgage here. The good news is that rising rates also mean that a fixed rate mortgage breakage fee often no longer applies.

Commenting on the analysis Mark Coan, Managing Director of moneysherpa.ie said “Our analysis highlights the massive opportunity people have to save by switching mortgage. Over a quarter of mortgage holders can save an average of €15,000 across their remaining term.”

“Mortgage switching is the single biggest thing most of us can do to get our finances in shape. If you aren’t on a tracker or fixed rate you should almost certainly switch.”

“As the cost of living crisis deepens, clawing back money lost through high interest payments can help lift the burden on households and inject money back into the local economy”

You can check out how much you would save using our remortgage repayment calculator, compare rates with our mortgage switcher calculator Ireland or you can read more about switching mortgage Ireland 2022 here.

Check our best mortgage broker Ireland reviews for brokers that offer switching for free and our article on the legal costs for switching your mortgage.

You can find more general information on mortgages and the process in these articles Help to Buy scheme (HTB), First Home scheme , mortgage Approval In Principal and mortgage drawdown.

If you are looking to release cash from your home you can also take a look at our mortgage top up Ireland guide here or if you are over 55 our equity release Ireland guide here.

County by County Breakdown

Information correct as at 31/06/2022

Tags: