Have you had your Credit ReUnion?

Letterkenny Credit Union is inviting its members to contact them about their ‘Credit ReUnion’ as they launch a brand new car loan campaign.

Letterkenny Credit Union has developed the new campaign in response to a recent upsurge in car loan queries, and as part of its ongoing commitment to tailoring services to the specific needs of its members.

The loan is available to all members, regardless of whether they have been active with the credit union recently or not.

Commenting on the new campaign, Paul Hume, chairperson of Letterkenny Credit Union said: “At Letterkenny Credit Union we always stand ready to serve the needs of the local community.

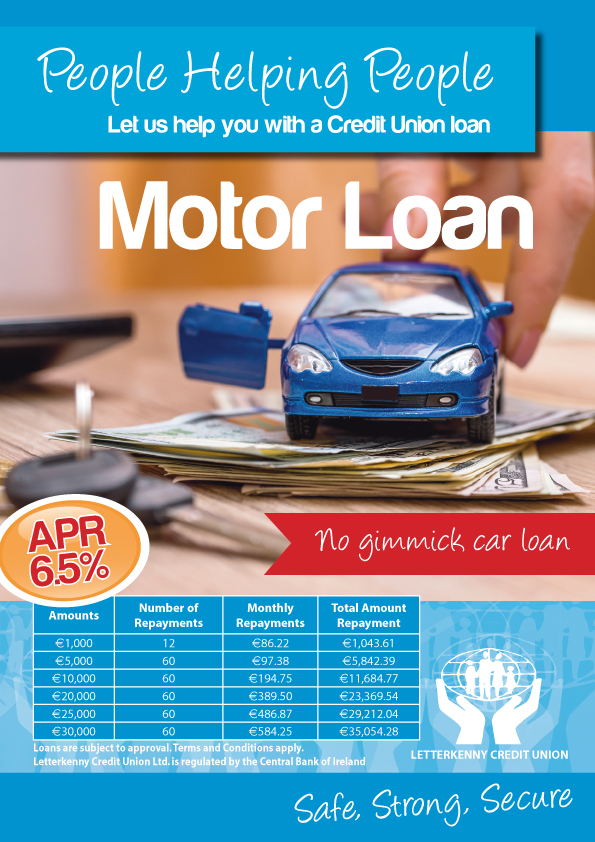

“We’re launching our new car loan campaign to remind all our members of the fact that the loan has straightforward terms and conditions, and is very affordable with a great value APR rate of 6.5% *.

“We are looking forward to reconnecting with those members we have not seen in a while, and chatting to those members we know well, to tell them more about this loan.”

Additional benefits include;

- quick turnaround time on loan decisions

- the loan is available with no savings multiple applying

- there are no penalties for paying a loan back early

- repayments can be restructured to suit each members’ individual budgets

Paul continued: “It’s also important for our members to know that credit unions are regulated by the Central Bank of Ireland, unlike PCP agreements.

“With a car loan from Letterkenny Credit Union, the car is yours from day one, you are free to sell on at any time you wish, and you don’t have to deal with the balloon payments that come with PCP agreements.

“So, we are saying to all our members to drop into us for a catch-up and to find out if we can be of help with any car purchases they might have planned.”

5 reasons why a Letterkenny Credit Union car loan is the way to go:

- You own it

Unlike other finance options such as hire purchase or personal contract plans, with an LKCU car loan, you own the car from day one. It’s yours to do with as you please. - No sneaky fees

There are no administration charges, hidden fees and no balloon payments. - Flexible repayment terms

You can pay off your car loan early, make additional lump sum repayments or increase your regular repayments, without a penalty. Other finance providers may charge you extra for paying them back faster. - Competitive rates (and maybe even a loan interest rebate)

As well as offering very competitive car loan rates, LKCU may offer loan interest rebates at the end of the financial year. - Free Loan Protection Cover

LKCU has taken out, at no extra cost to you, a loan protection insurance policy to protect and provide you with added peace of mind when you borrow. This free life assurance cover is unique to credit unions and is designed to pay off your loan in the unfortunate event of your death, thus relieving you of unnecessary future worry and relieving your loved ones of the burden of a debt owing.

For further information, please contact Letterkenny Credit Union or try out the loan calculator on our new website www.letterkennycu.ie

T: 074 91 24166 E: info@letterkennycu.ie

Connect with LKCU: LinkedIn | Facebook | Twitter | Instagram

* For a €20,000, 5 year variable interest rate loan with 60 monthly repayments of €389.47, an interest Rate of 6.3%, a representative APR of 6.5%, the total amount payable by the member is €23363.56 Information correct as at 28.11.2017.

Tags: