My mode of transport this week is the Una which is made in Italy. It’s the top of the range, I am told, it has high performance, leather, airbags and breathable climate control. I was so happy with the Una I ended up buying two of them!

Una Storia Italinia Imac Tex to give them their full title they are not in fact made by a car maker but by a shoe company! I bought my Unas from Alfie Greene for €100 at his shoe shop.

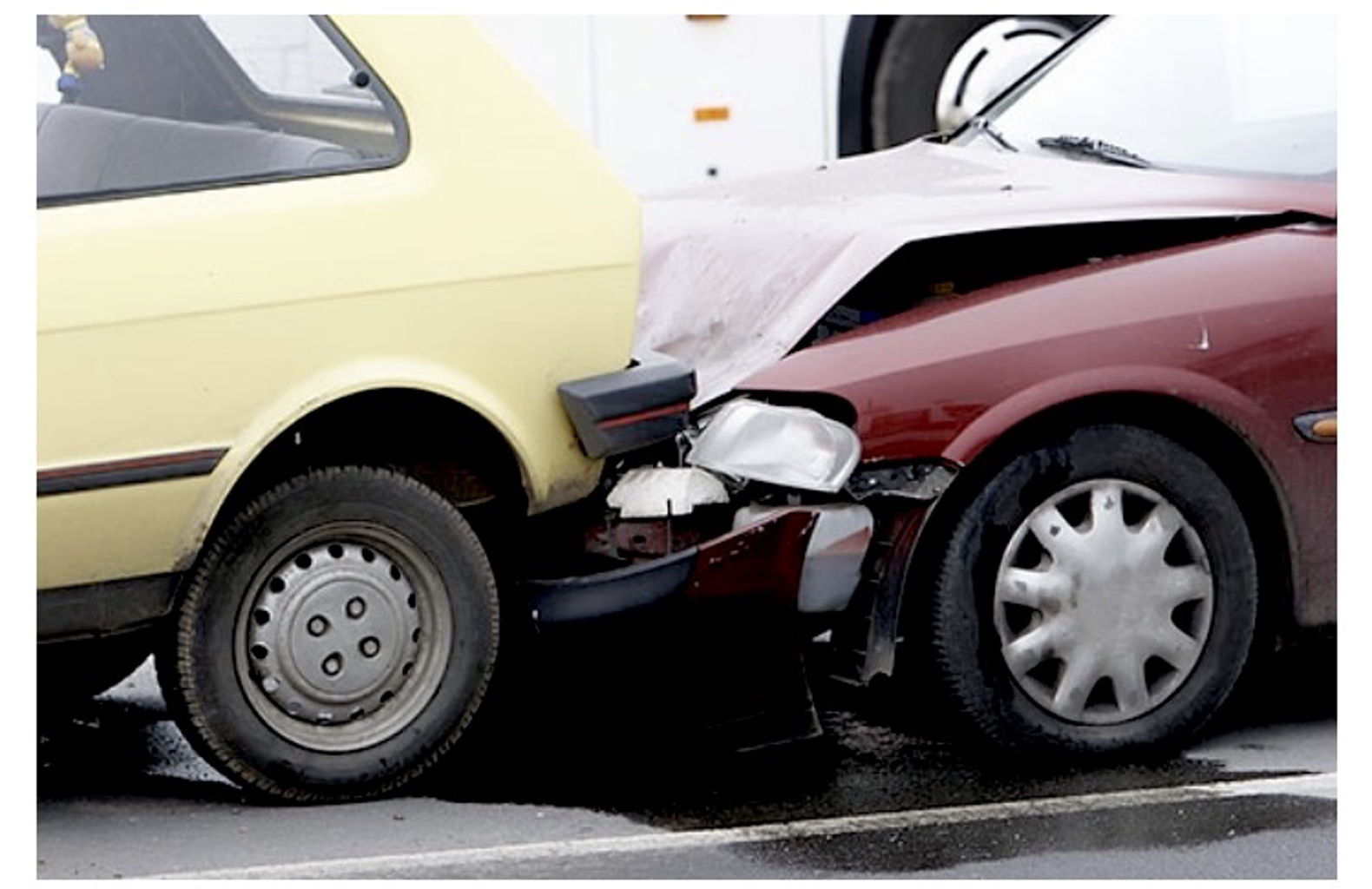

Shanks Mare and shoes might be the only mode of transport if car insurance costs rise any higher Photo Brian McDaid

Why am I talking about shoes and not cars this week? It’s very simple. I got an official looking letter in the post, which turns out to be my annual letter from my broker representing my car insurance company to say my renewal is due at the end of May. Normally this letter is reflection of my efforts to try and get another year in with out having to call my policy into action, I have tried to do this since I first got insured in my own name as far a back as 1983. On opening the letter from my friendly insurance company I receive the blow that my car insurance quote has increased by over 30% on the previous year.

It makes me so mad after looking after my policy and having no claims only to be informed my insurer who decide that they need to increase the cost for the incoming year. My new pair of Unas which are described on the box that they came in as “High Performance,” leather uppers, cushion soles and breathable all of which might come in very handy if this insurance for cars rises any higher we soon will be all back on “Shanks’ Mare”

It’s the law

We don’t have an option on insurance when you put a car on the road. It is against the law not to have a car insured when you go on the road. So most people don’t have a problem with that. It’s the way that insurance companies introduced things like their customer should also pay for them go on the road without getting car insurance. How mad is that?

Also at one stage it was cheaper for a woman driver to get insurance than a man. They were considered less risk. Looking back at that assessment, did they really care about who was the safer driver on the road or was it a case that they used a woman’s driving to condemn a man’s bad driving and in turn increase his cost on a policy?

Sitting in an Insurance brokers office this week awaiting a quote on my car insurance it donned on me that Insurance companies don’t care how careful a driver you are anymore as you are of far more value to them if you fall into a risk category that gives them freedom to load your policy to the roof.

The cost of car insurance cost have gone through the roof in Ireland in recent years.

We think when stats are giving telling us that young male drivers are the most likely to have or cause accidents but what about all the young male drivers on the road that don’t cause accidents? Why is it then okay to go with the flow and take massive premiums from young male drivers with out any effort to highlight good driving young males?

I do feel that local insurance brokers who have worked with generations of the same family over the years are now at the receiving end from very unhappy customers when they have to deliver the news that your policy has gone through the roof.

The first car Insurance in Ireland was as follows;

The Road Traffic Act, 1933 requires all drivers of mechanically propelled vehicles in public places to have at least third-party insurance, or to have obtained exemption – generally by depositing a large sum of money with the High Court as a guarantee against claims. In 1933 this figure was set at 15,000 pounds.

The Road Traffic Act, 1961 (which is currently in force) repealed the 1933 act but replaced these sections with functionally identical sections. Back in them days car insurance was a lot cheaper and a lot more straight forward. It was there because it was the law and the majority of drivers never had a claim. If you look at the car insurance today everyone is blaming everyone else for the high cost of insurance. Insurance companies blame both the profile of young drivers and the courts for awarding massive payouts on claims. Once upon a time Insurance companies were trusted and drivers felt that they were fair on drivers that had a clean driving record, now that has all changed.

Big Data

Companies are now moving towards information gathered by a new wave of experts form data bases which show trends and predictions of how humans may act. Even the way a driver answers questions on his application could effect the cost of his or her insurance. An example recently given was some one describing themselves as a company director, and someone describing themselves as a director of a company can end up with two different quotes.

My insurance is due at the end of the month. I have friends that have given up a full day to end up getting a good reduction on their insurance policy. I don’t think I would have the patients to sit at the end of a phone line for that long but I am not going to settle for the price my insurer has inflated my price to.

And finally…

My youngest brother Peadar will be on the road next week but on his feet as he will walk around Donegal over 8 days to raise awareness and funds for Mental Health wellbeing. These issue affects us all but we are not great when it comes to chatting or dealing with them.

Peadar McDaid who will start his 8 day walk next week around Donegal to raise awareness for Mental Health Wellbeing. Photo Brian McDaid

Over the 8 days the HSE will be giving talks in the areas that Peadar is walking in to give talk to groups.

If you see him out on the road give him a toot on the horn or a wave to give him a bit of encouragement on his trip around Donegal.

Peadar McDaid’s 8 day walk which start in Donegal next week please support if you see him on the roads Photo Brian McDaid

Happy motoring folks

Tags: